Investment Opportunities for Investors

Investment Opportunities For Investors

Earn good returns at the earliest!

Earn Big At Small Risk

GTech connects verified vendors and enterprises with investors looking for high returns. Businesses come on our platform to list their unpaid invoices. Investors help them with instant cash and earn returns higher than bank deposits.

Short Term Investment With GTech

Short-term investments form an integral part of any financial planning, especially to assist one’s short-term financial goal. These kinds of investments refer to marketable securities or assets that are used to provide a safe, temporary place for the cash while it awaits future deployment. Short-term investments are highly liquid assets designed for a short duration, typically ranging from 3 to 12 months. Seasoned investors suggest that effective long-term plans are often supplemented by short-term investments. These small financial achievements can have a significant impact in the long run in terms of supporting one’s financial goals.

While the market is showing signs of a bearish trend with rising interest rates, investors in India are increasingly turning towards short-term investments to earn remunerative returns. Unlike its counterpart, short-term investment provides optimal returns and liquidity, while ensuring minimum risk exposure due to shorter maturity timeframes. Hence, many new-age investors are increasingly finding short-term investment as a lucrative way to score competitive returns and high liquidity. Short-term investment in India is gaining traction among investors as they provide faster returns in a limited time.

What Is GTech?

GTech, an invoice discounting platform, provides investors with a unique opportunity to invest in unpaid invoices of high-growth businesses, thereby allowing investors to earn remunerative returns in a short time span.

Diversify Your Portfolio With GTech

With market volatility on a constant rise, investors are on a continuous lookout for investment options outside the traditional portfolios like stocks, bonds, and more. This is why alternative investments came as a viable option for investors to hedge their portfolio against market inflation and earn high returns. GTech’s invoice discounting marketplace enables investors to earn high returns by investing in a brand-new asset class, which otherwise has been only accessible to banks and institutional investors.

Benefits Of Short-Term Investment

|

Flexibility |

In the case of short-term investments, investors don’t need to park their cash for an extended period of time. Since the lock-in period is less, it allows investors to deploy the returns into some other security. |

|

Diversification |

Since short-term investments have small parking period, they are less vulnerable to market depreciation in terms of returns, as investors tend to invest in a wide array of securities. As the amount is scattered into different asset classes, the risk associated with it also spreads out. |

|

High Returns |

With the emergence of new-age alternative investment vehicles like invoice discounting, investors can invest a small amount and earn high returns in a short time. |

Why GTech?

GTech provides an alternative short-term investment option for investors with minimal risk exposure. The invoice discounting platform offers investors with a safe investment option to maximize yields, while guaranteeing a substantial portfolio diversification at an above-market rate, wherein:

The GTech business model employs a 360° risk analysis system which takes place at multiple stages wherein all the aspects of the invoice are assessed to ensure investors don’t face any execution risk.

All the invoices uploaded in the GTech platform goes through a stringent verification process to maintain legitimacy and safeguard the interest of the investor.

GTech screens the security of each transaction through Escrow Accounts for both Businesses and Investors, individually.

The GTech Advantage

Unique alternative fixed-income short-term investment

Invest in a brand-new alternative asset class

Earn above-market returns

Short-term investment cycles of 30-90 days at low-risk

Robust Risk Mitigation

Comprehensive risk management with no execution risk

360° credit risk analysis system at multiple stages

Multiple verifications of the relationship between borrower and enterprise

Who Can Invest In GTech?

To start investing in GTech, one has to be:

Individual resident investors

HUF / Proprietorship registered in India

Institutional investors

Banks, NBFCs and other Financial Institutions

NRI investors (Provided you have an NRO account and comply with basic predefined KYC guidelines- Pan card and valid Indian address proof.)

An adult citizen of India (can be an NRI too)

Should invest a minimum of INR 3 lakh

Should hold a valid PAN card

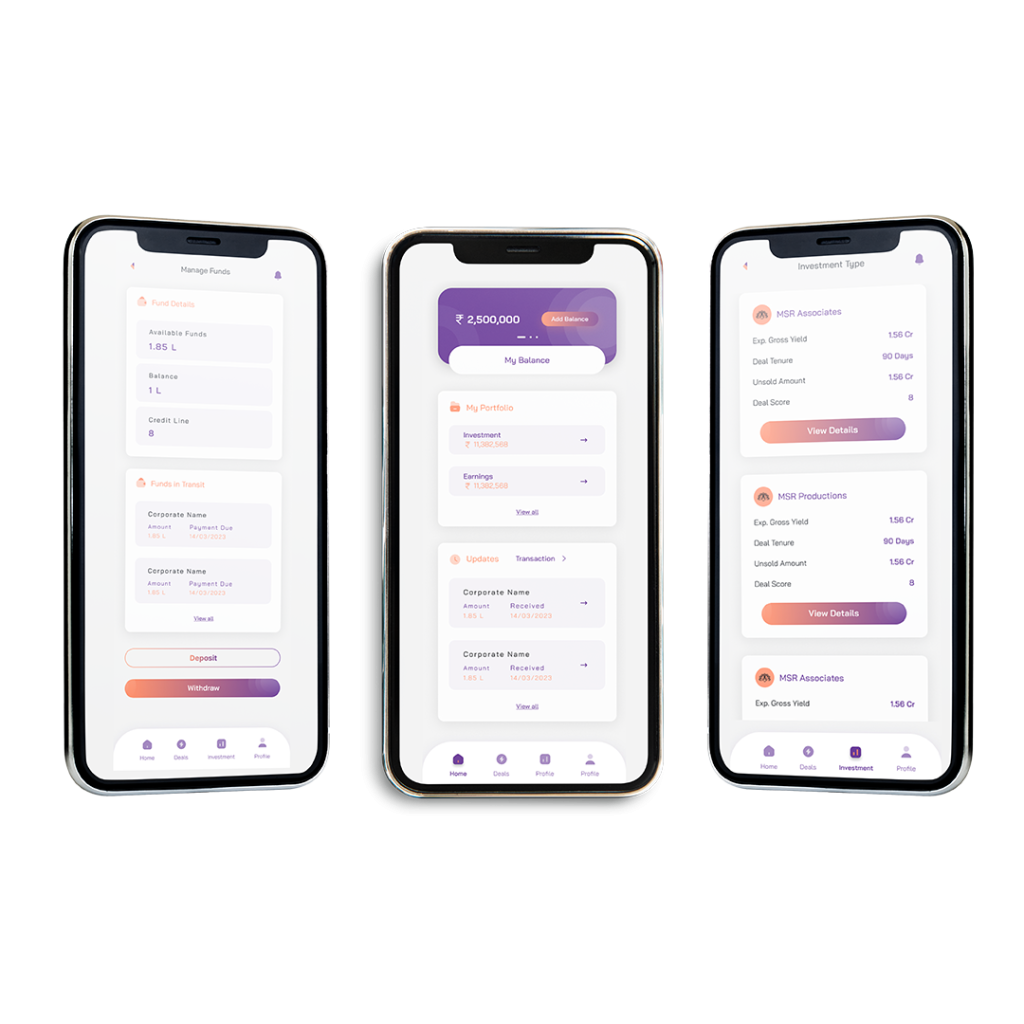

How GTech Invoice Discounting Platform Works?

Investor signs up on GTech and logs into the GTech account

Investor purchases invoices of their choice

Funds are disbursed to vendor’s bank account in 24-72 hrs through escrow account

Upon tenure completion, enterprise credits invoice amount into an escrow account

GTech then transfers this amount to the investor

Investors can potentially make higher profits depending on the invoice they are discounting in 30 to 90 days

Ready To Grow Your Investments?